Common Market Organization

DGRM is responsible for managing the Common Organization of Markets for Fisheries and Aquaculture Products (CMO), supporting and following the initiatives of Producer Organizations (PO) since the first sale

Common Market Organization

Breadcrumbs

- Fisheries

- Industry and Markets

- Common Market Organization

The setting of these rules applies to certain species of fresh fish as well as canned sardines, tuna and bonito.

Compliance with the marketing standards becomes imperative, and can only be commercialized becomes imperative for the products in question, and only those that meet the established quality and calibration criteria should be marketed.

This option has a dual utility:

- Define harmonized commercial characteristics for products across the Union, allowing to differentiate common prices for each category of products, so that a price regime can be applied according to market realities

- Contribute to maintaining the quality of the fish, in order to facilitate its disposal.

Producer organizations (POs) are a fundamental component of the common organization of the markets in fisheries and aquaculture products (CMOs), and it is through them that the sector seeks to organize and stabilize the market.

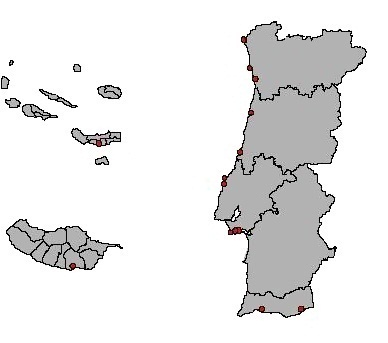

DGRM is the entity that proceeds to recognize or withdraw recognition of POs in Portugal.

It is important that POs take advantage of the sense of collective responsibility and combine individual efforts to achieve common goals in terms of production and activities upstream and downstream. Beneficiaries of this system are member producers, excluding any other agents in the sector. Producers joining a PO is an optional act.

Among the specific activities of POs, production and commercialization plans stand out. POs can also carry out activities related to the conclusion of fish supply contracts, ensure the temporary storage of fishery products and guarantee the outflow of production from their members.

At the same time, POs have different complementary activities, with emphasis on:

- Intermediation in obtaining financial credit and technical support

- Supply of fishing and navigation materials to members

- Ship maintenance and / or repair services

- Operating cold units

- Participation in companies selling or processing fishery products

- Promotion (or collaboration in promotional campaigns) of products of its members.

Given the unpredictability of fishing activities, the temporary storage of fishery products for human consumption contributes to greater market stability and to the valorisation of products, creating, in particular, added value.

This intervention mechanism is applied exclusively by POs and comes into action when the products placed on the first sale reach a threshold price that triggers their operation.

Trigger Prices for 2018

![]() Download (188 KB)

Download (188 KB)

Rules and Criteria

Help Storage Rules and Criteria

Technical and Financial Costs for 2016, 2017 and 2018

![]() Download (36 KB)

Download (36 KB)

Producer organizations (POs) must guide the activities of their members in line with the objectives of the common fisheries policy (CFP) and the common organization of the markets (CMO), favoring the valorisation of catches.

For each fishing campaign, POs must prepare and submit a production and marketing plan to DGRM, specifying the necessary elements in the production schedule, marketing strategy and measures to achieve their objectives. DGRM will approve this plan.

POs must also submit to DGRM, for approval, an annual report of their activities within the scope of the production and marketing plan, thus evaluating its effectiveness.

A: The PO can allocate personnel expenses, including those mentioned above, in the preparation and execution of the PPC. However, you must indicate a percentage (%) adjusted to the time that was actually spent by the employees and performed tasks within the scope of the respective PPC.

Q: What documentation / proof will be required by DGRM / AG to justify the assignment of these workers to the PPC for each year?

A: The PO must prove the employees' bond. For the purpose of justifying the respective PO, a statement or table referring to the% of allocation of costs incurred with personnel is sent. In terms of personnel costs, the corresponding proof of expenditure must be presented in due course by the PO in connection with the request for payment of support.

Q: The consumables (reams of paper, ink cartridges, toners), as well as the maintenance or purchase of a printer or photocopier, which are used throughout the year due to the PPC in which way can they be charged?

A: With regard to consumables, the PO must likewise allocate to PPPs, a% of the global expenditure on these goods. For this purpose, you must prove with the expense document the acquisition of said consumables and, in the document itself, indicate the respective imputation rate. Regarding the purchase of a printer or photocopier, they may be eligible, provided their need to demonstrate the tasks under the PCC is demonstrated.

Q: Regarding the purchase of consumable goods, is it better to present several invoices or purchase a reasonable quantity at the beginning of the year (in a single invoice) and allocate to the PPC right away?

A: We leave it to the OP's discretion as long as the expense is attributable to the preparation and execution of the PPC for year x and is duly proven.

Q: Are travel expenses for meetings to deal with issues related to the implementation of measures or actions provided for in the PPC, eligible?

A: They are eligible as long as they are included in the PPC and duly proven in the respective Activity Report (AR), as well as the entity (ies) involved and the object of the meeting are identified. The supporting document must be a map on OP letterhead, dated and signed. This map must contain the employee's identification, the number of Km, the unit cost of the km (according to the tables adopted for State employees), the total amount and the identification of the meeting or event to which it refers, must attach the document of the event or summons to the meeting. When requesting payment, the PO must register the statement of expenditure at full cost as proof of expenditure.

Q: As part of the “improvement of the economic profitability” of the members of a PO, the respective strategy involves the purchase of fish in Lota, from the vessels that are members of the PO, destined for a processing establishment (for example, canning factory…). Is the purchase of these species at auction supported?

A: No. Expenses that aim at the identified objective may be eligible, but not the cost of purchasing the fish, as it will later be marketed.

Q: Are production and packaging costs also eligible?

A: No.

Q: Can the measures foreseen in the PPC that relate to investments in other support schemes under the PO Mar 2020 support, regulated by specific ordinances, be supported under the regulation of the PPC support regime?

A: Support for investments for which a specific PO Mar 2020 regime is available must be submitted under the regime to which they relate, although they must be referenced in the PPC.

Q: An investment that aims to meet a certain objective in a given year, within the framework of a PPC, can be made in another year, (depending on financial availability), since the application is multi-annual?

A: The PO can achieve objectives through multiannual execution measures (to be indicated in the PPC), however, it must prove the execution of the annual installment in the respective Activity Report. Measures of an annual nature or the annual installment of a measure must be carried out in the year to which they relate and be confirmed (with expense documents, if applicable) in the respective Activity Report. Expenditure documents are also indispensable for co-financing the amounts presented in the respective applications.

Q: In the expenses already incurred and paid, should budgets be included or in these cases, just present the invoices?

A: With invoices, budgets are not necessary, and a copy of the invoices can be integrated into the application.